1. Junk Food in the UK

In the United Kingdom, junk food is heavily taxed through a “sugar tax” on sugary drinks and snacks. The government introduced this initiative to combat rising obesity rates and encourage healthier eating habits. It’s a part of the UK’s broader strategy to tackle public health issues that stem from unhealthy diets. You’ll find that soft drinks, chocolate bars, and other high-sugar foods are taxed at a higher rate, making people think twice before indulging. While Americans can easily grab a sugary soda or snack without worrying about extra costs, the UK’s tax system aims to discourage overconsumption shares the Guardian.

The idea is that by making junk food more expensive, people will opt for healthier alternatives, and the revenue raised goes back into health-related programs. It’s not just limited to sugary drinks—snack foods with high levels of sugar, salt, or fat are also in the crosshairs. This is part of the UK’s drive to improve the nation’s overall health without completely banning certain foods. The sugar tax, though controversial, has sparked important conversations about the balance between personal choice and public health responsibility adds Forbes.

2. Fast Food in Denmark

Denmark is known for its high taxes on fast food, which is not only expensive but also heavily taxed due to its perceived negative impact on health. While Americans are used to grabbing a quick, affordable meal from their favorite fast food chains, in Denmark, those same meals come with a premium price tag. Fast food like burgers, fries, and fried chicken are all taxed at a higher rate to reflect the environmental and health costs associated with these foods. The Danish government uses the revenue from these taxes to fund their robust healthcare system says Snopes.

Unlike in the U.S., where fast food is seen as an affordable and accessible choice for busy families, Denmark is encouraging its citizens to make healthier food choices by making fast food less attractive financially. This taxation also reflects the country’s commitment to environmental sustainability. The production of fast food, particularly beef, has significant environmental impacts, and Denmark’s taxes are designed to reduce this effect. In this way, Denmark is seeking a long-term shift in eating habits that favor sustainable and health-conscious diets adds the Times.

3. Unhealthy Snacks in Finland

In Finland, there is a noticeable tax on foods that are high in sugar, salt, and fat, including many packaged snacks. These types of foods, like chips and sugary pastries, are taxed to promote healthier choices and reduce the national burden of chronic diseases linked to poor diet. Americans may not think twice about reaching for a bag of chips or a sugary snack, but in Finland, these indulgences are seen as luxuries that come with an extra cost. Finland’s government uses the revenue to subsidize healthier foods and fund healthcare programs.

This approach has been fairly effective, as Finnish consumers are more conscious of their food choices compared to Americans. Finnish residents are encouraged to choose foods that provide nutritional value rather than empty calories. While it may sound restrictive, this tax system is in place to help curb the rising rates of obesity and related diseases. It’s a delicate balance between personal freedom and collective responsibility, but Finland has been proactive in making the healthier choice the easier choice for its citizens.

4. Petrol in Norway

Norway has one of the highest petrol taxes in the world, and it’s a direct reflection of the country’s commitment to environmental sustainability. While Americans are used to relatively lower gas prices, especially when compared to other countries, Norwegians pay a hefty price at the pump due to high taxes. The taxes are meant to encourage the use of public transportation, electric vehicles, and other more sustainable alternatives. The goal is to reduce the nation’s carbon footprint and make environmental conservation a part of everyday life.

Norway’s efforts are helping to transition the country toward greener energy solutions. The high cost of petrol pushes citizens to adopt electric cars, which are heavily incentivized by the government through tax breaks and rebates. With its focus on reducing emissions, Norway has also invested in green infrastructure like charging stations and a robust public transit system. These taxes, while seemingly high, are part of a larger environmental strategy that aligns with Norway’s long-term climate goals.

5. Bottled Water in Italy

While it may seem strange, bottled water is taxed in Italy in an effort to reduce plastic waste and encourage the use of tap water. In the U.S., grabbing a bottle of water from the store is an everyday occurrence with no additional cost, but Italians pay more for their convenience. The tax on bottled water is designed to discourage the reliance on single-use plastic bottles and help tackle the country’s growing waste problem. This form of taxation is also seen as a way to protect the environment by promoting more sustainable practices.

Italians often have access to clean, potable water straight from the tap, making the need for bottled water less necessary. In addition to the tax, Italy has implemented initiatives to increase the availability of water refill stations throughout cities and towns. This helps to create a culture where tap water is seen as a convenient and eco-friendly option. While it might seem like a small change, the taxation on bottled water reflects Italy’s larger environmental goals and commitment to sustainability.

6. Digital Services in the EU

In the European Union, digital services such as streaming platforms and online purchases are often taxed at a higher rate than in the U.S. This includes services like Netflix, Spotify, and even digital books. While Americans enjoy a largely tax-free experience when it comes to streaming and digital goods, Europeans are accustomed to paying an additional tax for these services. The EU’s Value Added Tax (VAT) system means that these digital products are taxed as part of a broader effort to standardize sales tax rates across member countries.

The goal of this tax is to create a level playing field between physical and digital goods, ensuring that services and products purchased online contribute to the country’s tax revenue. This can make certain services more expensive for Europeans compared to Americans, but it also helps fund public services like healthcare and education. Additionally, this taxation system aims to prevent large multinational corporations from bypassing taxes by operating from low-tax jurisdictions. While it may be frustrating to see an extra charge for services that are easily accessible in the U.S., the EU’s tax system is designed to ensure fairness and equity in the digital economy.

7. Gasoline in the Netherlands

Gasoline in the Netherlands is heavily taxed, making it one of the most expensive places to fill up your tank in Europe. The Dutch government imposes high taxes on gasoline as part of their strategy to reduce fossil fuel consumption and combat climate change. While Americans may grumble at gas prices, they are significantly lower compared to what Dutch citizens face. These taxes are designed to encourage the use of bicycles, public transportation, and electric cars as more eco-friendly alternatives to driving a petrol-powered vehicle.

The Netherlands has long been a pioneer in cycling culture, with a robust infrastructure that makes biking both practical and popular. With the high cost of gasoline, Dutch citizens are more likely to rely on these alternative modes of transport, especially in urban areas where public transportation is widely available. The government uses the revenue from gasoline taxes to invest in green infrastructure and environmental initiatives. The higher gas prices are part of a broader push to create a sustainable, low-emission future for the country.

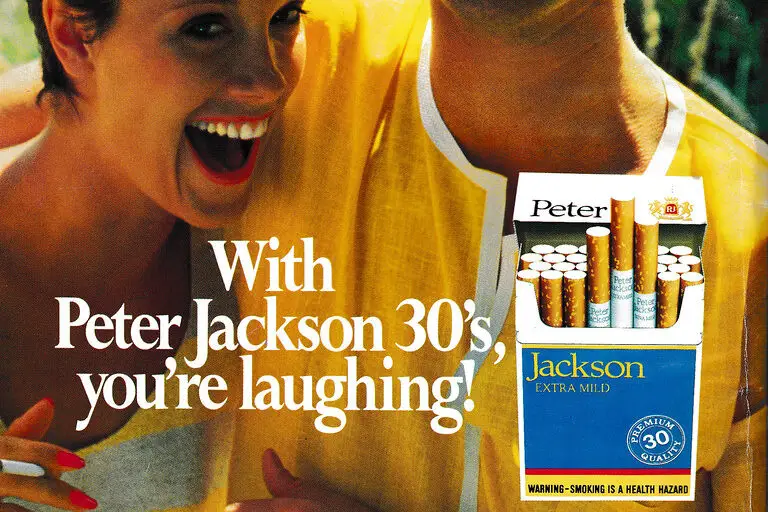

8. Cigarettes in Australia

Australia has some of the highest cigarette taxes in the world, which are part of the country’s aggressive anti-smoking policies. While Americans can easily pick up a pack of cigarettes for a relatively low price compared to other countries, Australians are faced with steep taxes on tobacco products. The government raises cigarette taxes regularly as part of a strategy to reduce smoking rates and improve public health. These taxes are considered effective in encouraging smokers to quit or reduce their consumption over time.

Cigarette packs in Australia are also required to have graphic health warnings that cover much of the packaging, and some packs are completely plain with no branding. This combination of high taxes and strong visual health messages has helped Australia achieve one of the lowest smoking rates in the world. The revenue generated from tobacco taxes is used to fund public health campaigns, smoking cessation programs, and healthcare services related to smoking-related illnesses. While these policies may feel restrictive, they have contributed to a healthier population and a reduction in smoking-related deaths.

9. Luxury Goods in France

In France, luxury goods such as high-end jewelry, designer clothing, and expensive perfumes are subject to significant taxes. While Americans may be able to buy these items without an added tax, French citizens pay a premium for their designer purchases. The luxury tax is meant to redistribute wealth and reduce the consumption of goods that are seen as non-essential. The proceeds from these taxes are often directed toward social programs aimed at helping lower-income citizens.

Luxury goods are taxed at a higher rate as part of the country’s broader commitment to wealth equality. This helps to ensure that the affluent contribute a fair share to the economy, while also encouraging more moderate consumption among the wealthy. The luxury tax in France is seen as a way to curb excess and promote a more balanced society. While it can make luxury items more expensive, the overall aim is to create a more equitable distribution of resources.

10. Heating Bills in Germany

In Germany, heating bills are often subject to higher taxes due to the country’s energy policies. Unlike in the U.S., where heating costs can fluctuate but aren’t taxed in the same way, Germany imposes a “carbon tax” on heating fuels to reduce carbon emissions. The idea behind this tax is to make homeowners more conscious of their energy usage and encourage the use of renewable energy sources. While heating bills can become quite expensive, the revenue generated from these taxes is invested in green energy initiatives.

Germany’s commitment to reducing its carbon footprint means that residents are incentivized to use energy-efficient appliances and adopt greener heating methods. The tax is part of the country’s larger efforts to transition away from fossil fuels and towards renewable energy. While the tax can increase monthly heating costs, it also supports the country’s ambitious climate goals. German citizens are encouraged to invest in energy-efficient systems and take part in the collective effort to reduce carbon emissions.

11. Bank Transactions in Switzerland

In Switzerland, financial transactions are subject to taxes that don’t exist in the U.S. This includes both personal and business transactions that take place through banks. Swiss banks charge a small tax on transfers, withdrawals, and other types of financial services. While this may seem like a nuisance to Americans who enjoy tax-free banking, it’s part of Switzerland’s broader financial ecosystem, which includes high taxes on wealth and income.

These banking taxes help fund public services like healthcare, education, and infrastructure. The Swiss government also uses these taxes to ensure that the wealthiest individuals and corporations contribute fairly to the economy. While banking fees are higher in Switzerland, the country offers excellent public services in return, including a robust healthcare system and efficient public transportation. The tax on financial transactions is just one part of a larger system aimed at creating a fair and balanced society.

12. Taxis in Japan

In Japan, taxi fares are not only based on distance but are also subject to taxes that make them more expensive compared to the U.S. Taxis in Japan have high starting fares, and additional charges are added for luggage, late-night rides, or rides to outlying areas. This might seem like an inconvenience to Americans who are used to relatively low taxi rates, but these additional costs are part of a larger structure aimed at supporting the country’s public transport network. Japan’s public transport system is extensive and efficient, so taxis are generally seen as a last resort.

The high costs of taxis are also a reflection of Japan’s strict regulations and the wages of taxi drivers. The taxi industry is tightly regulated to ensure a high standard of service and a safe, reliable experience. The additional costs help maintain this standard, while also encouraging people to rely on the more affordable public transport options available. Taxis are still widely used in certain situations, but the higher fares reflect Japan’s broader transportation strategy, which prioritizes efficiency and sustainability.